When was the last time you said, “it’s only $5 to use this ATM, and I’m too lazy to walk any further to find another teller machine?”

When was the last time you said, “it’s only $5 to use this ATM, and I’m too lazy to walk any further to find another teller machine?”

If it’s recent then you’re probably not alone, and that’s not entirely a bad thing. But when you start to repeat yourself, that’s when Houston – we have a problem.

It’s estimated that Australians are paying some $32.6 billion in card debt and this money is accruing interest which on average is charged at 19.75 per cent, according to data provided by the Reserve Bank of Australia.

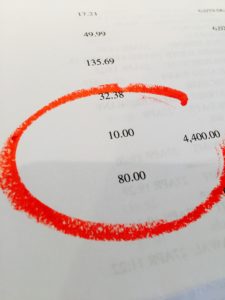

A quick scan of any bank statement or bill, armed with a highlighter or old lipstick for marking up – which we hope you are doing on a regular basis rather than allowing paper work to pile on the sideboard – might show the following common fees.

- Insufficient funds fees: $9 for a bank honour fee

- Phone or internet late fees: $30 for a late fee on a Telstra bill – opps!

- Credit card interest charges: $10 in credit card interest

- ATM fees: $5 a month for using non-bank teller

- Foreign transfer fee: $3 or a nice little percentage of whatever it was you bought or charged offshore.

The list can and does go on. It also quickly adds up and you may well be throwing away $10, $20, or $50 a month by paying fees which could be eliminated with a little more organisation and attention to your financial affairs.

If it’s $20 a month, that’s money which could be invested in a high interest savings account earning 4 per cent. That’s 1,354.82 after five years or $2,984.63 over 10 years for doing absolutely nothing but collecting those fees – all thanks to the benefit of compounding

So here’s what we want you to do. STOP WITH THE EXCUSES!

Once you stop making up reasons for why you don’t mind paying fees or interest charges for things that really can be avoided, then you will start to reduce the amount you are effectively donating to the banks and other services providers.

Also, if someone you know hassles you for being tight with your money or a scrooge because you are trying to avoid paying non-bank ATM fees or you’re opting for direct debit payments instead of using your credit card, embrace it and pat yourself on the back!