When making the big decision to take on a home loan, knowledge is power. With Australian women often the handlers of household finances, it comes as a surprise to learn they’re not as confident in their understanding of common home loan terms.

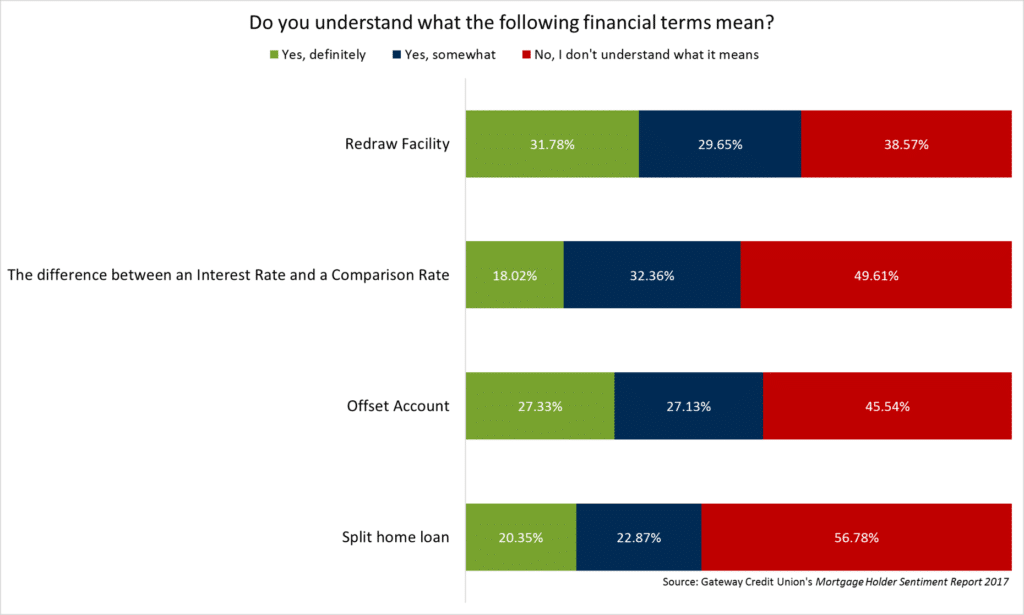

Recent research from Gateway Credit Union’s Mortgage Holder Sentiment Report 2017, found that the most commonly misunderstood terms among women include:

- Split your risk

Split home loans

A split home loan facility allows you to get the best of both worlds by enabling you to fix a portion of your loan, whilst keeping another part variable. Thereby, offering the dual benefit of protecting you against sudden rate rises but also allowing you to take advantage of current low rates.

A flexible lender will allow you to choose what portion of your loan you would like to fix and what portion you would like on a variable interest rate. Some lenders also offer multiple splits, so you can tailor the loan to suit your needs and use different strategies to achieve home ownership sooner.

You can split your home loan at any time – during the application process or after funding. Be aware, if you choose to split after funding it may incur additional costs.

- Have a safety net

Redraw facility

A redraw facility helps you create greater security by offering you a financial safety net.

Extra repayments you make on a variable rate home loan are considered accessible funds. These funds are available for you to ‘redraw’ for any purpose or emergency. You can put every dollar into your home loan, thereby reducing the amount of interest you pay, but with the flexibility to redraw these additional payments when you need to.

While some lenders will give you a few free redraws be sure to check the fine print, as there may be additional fees for withdrawing money. There may also be restrictions on how much and how often you can redraw in any given period.

- Pay off your home loan faster

Offset accounts

An offset account is a great feature to help you reduce the amount of interest you pay over the life of your loan. An offset account is a savings or transaction account that is linked to your home loan. The money you have in this account “offsets” against your outstanding loan balance and helps reduce the interest you pay. For example, if you have $300,000 owing and $30,000 in your 100% offset, you only pay interest on $270,000.

Not only does it help reduce the interest charged on your loan but as the funds sit in a transaction/saving account, you still have complete access to the money when you need it. Like the split option, most lenders will allow you to have multiple offset accounts, so you can conveniently use all your different funds to offset the home loan. Even if you have smaller amounts sitting in your offset, over time you can make significant interest savings.

- Know your rate

Interest rate vs. Comparison rate

Why are two rates always showing? What is the difference, and which should I look at?

The interest rate is the amount charged by a lender for the use of the funds they lend you. It is expressed as a percentage of the principal borrowed, per annum.

A comparison rate is a way to identify the true cost of a home loan. It includes both the interest rate and the fees and charges combined into a single percentage figure to calculate the actual cost of the loan. Fees and charges include: set up costs such as valuation and establishment fees and ongoing costs such as annual package fees. It does not include fees such as government stamp duty and break fees.

When comparing different rates from lenders you should always look at the comparison rate. This ensures you’re comparing apples with apples. For example, lender A might offer a home loan product with an interest rate of 3.80% p.a., while lender B offers a similar home loan product with an interest rate of 3.90% p.a. However, once you factor in all the fees and charges lender A’s product might have a comparison rate of 4.20% (because it had higher fees and charges), while lender B’s comparison rate sits at 4.10% p.a.