The latest Women’s Index is out and I’d love to report that the push for economic equality is getting easier, but the truth is anything but.

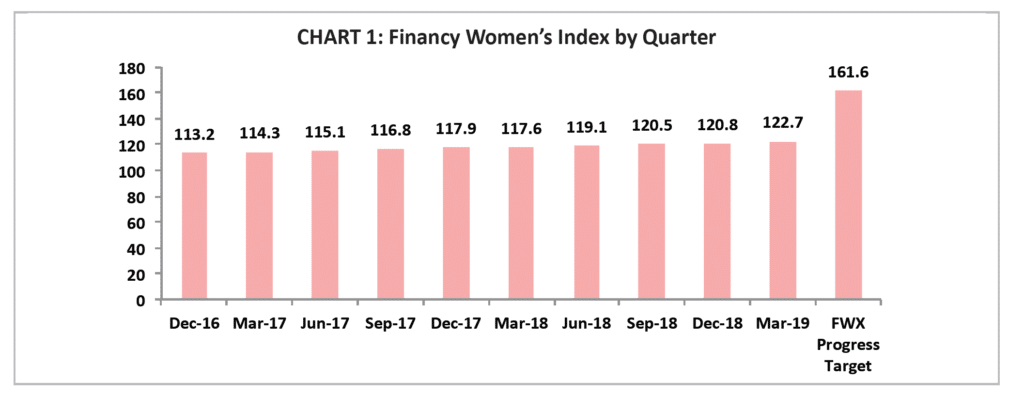

The Women’s Index, which measures female economic progress across work, wages, education, leadership and superannuation, rose 1.9 points to 122.7 points in the March quarter, up from a revised 120.8 points in December 2018.

This means that Australian women are on the whole making gains towards improving their financial situation.

In fact, the Financy Women’s Index for the March quarter recorded the fastest pace of women’s quarterly progress in two years, helped by record female full-time employment, workforce participation, improved educational enrolments and earnings growth relative to men as reflected in a record low of the gender pay gap

But when the March result is compared against the aspirational guide on economic equality, the FWX Progress Target* of 161.6 points, it shows that women are still 34% short or 12 years away from achieving financial equality. And even then it will be a slow burn the closer women get to realising that goal.

Here’s a breakdown of what happened in the March quarter and my polite views on it.

- The March Financy Women’s Index rose 1.9 points to 122.7 points. “This is a good thing.”

- The result was helped by record full-time employment, participation, tertiary enrolments and a record low gender pay gap. “Tick.”

- But little improvement in women occupying ASX 200 board positions and a lagging gender gap in superannuation weighed on the results. “Not good.”

- Australian women are 34% short or on current trends, 12 years away –at the current rate of improvement – from achieving financial equality. “Disappointing as I’ll be among those women nearing the end of my career but on a brighter note, my daughters like many young girls, will be just starting out in the workforce.”

“Its great to see that the latest issue of the Financy Women’s Index shows that women are continuing to make ongoing progress towards achieving financial equality with men,” said AMP Capital Head of Investment Strategy and Chief Economist Shane Oliver.

“Progress in educational attainment is a particularly good sign for the future but there is still a long way to go notably in terms of the pay and superannuation gaps to men and in underemployment,” said Dr Oliver.

Key findings of the Women’s Index discussed

Education data shows that more women than men are enrolling in tertiary studies to better their qualifications but the overall gender gap in undergraduate salaries widened in to 4.8% in 2018, from 1.8% in 2017.

Technical course areas, such as IT, Mining and Engineering, which remain male dominated and generally higher paying, are becoming increasingly sought after by women.

The number of women in full-time employment hit a new high of 3.23 million in the March quarter, just as the female underemployment rate declined by 0.2% to 10.5% in January (versus 6.3% for males), from 10.7% in January 2018.

However the level of underemployment is worse than it was in 2009 when the underemployment rate for women stood at 8.8% compared to 5.2% for men.

The number of women occupying ASX 200 board positions rose to 29.7% in February after a dip to 29.6% in January. However a disappointing end to 2018 appears to have affected the momentum seen earlier in support of gender board diversity.

Connie McKeage CEO of Australian listed fintech company OneVue said more needs to be done to support women who want to work, particularly those with children or caring for loved ones.

“I would encourage all employed persons considering starting a family, or who have started a family to stay engaged in the workforce. Even if this means you are only available to work a few hours one day a week.

“As an employer for those employees unable to continue working for a period of time, particularly during maternity or paternity leave there is no reason these employees cannot be invited to log into staff updates, key presentations etc so that they continue to feel like a valuable team member.”

The sectors that recorded the biggest drop in their gender pay gaps in the March quarter are male-dominated and include Construction and Transport, Postal and Warehousing with respective declines of 2.6 percentage points to 12.5% and 2.1 percentage points to 15.7%.

Financial and Insurance Services and Health Care and Social Assistance, which is the most female dominated, continue to be the worst performing industries for the gender pay gap, which rose by 0.2 percentage points to 26.9% and 0.8 percentage points to 25.8% respectively in November.

“The financial sector holds the unenviable title of the least equitable for its mean pay gap of 26.9%,” said AFA Inspire National Chair Kate McCallum.

“This is not a woman’s problem. This is a system problem. There are inherited systems and structures in financial organisations that simply don’t support women to thrive. Most companies acknowledge this and are already doing some great stuff. The challenge is, we’ve been trying to eliminate the pay gap for years and it’s not budging. It’s time for bold moves.”

A lagging lifetime superannuation gender gap also held back the progress score. The average account balance for women is 34% less than that of the average man.

AMP Financial Planning adviser Dianne Charman said the Financy Women’s Index was an excellent tool to remind women of how important taking a proactive stance with their superannuation was for their retirement.

“Whether your retirement is close or quite a few decades ahead of you, everything you do today to be proactive about improving your financial position will mean you’ll forever thank your younger self,” she said.

Ms Charman said key super issues women should be thinking about were: salary sacrificing and after-tax contributions, exploiting the new rules around catch-up contributions and understanding the impact of different investment options within super.