You know a tax system is broken when women are taxed more than some of the world’s biggest corporations in Australia.

“Nurses, teachers, and retail and hospitality workers are all paying more tax than some of the worlds largest corporations,” says GetUp Campaigns Director Django Merope-Synge.

He made the comments after data from the Australian Tax Office revealed that more than 730 of the largest corporations in Australia paid $0 tax, up from 678 the year before.

Now I don’t know about you, but I have just received a tax bill for about $2500 after my investment property made a nice profit that pushed me into a higher tax bracket than the sum of my earnings and maternity leave payments.

That $2500 is just painful, especially when you consider the average tax return is about the same amount.

Don’t get me wrong, it’s good to have an investment property that is profitable. But when I hear that some 730 companies are not paying tax, I see red. Really red.

What’s more, most of the occupations cited above are dominated by women working in non-managerial roles.

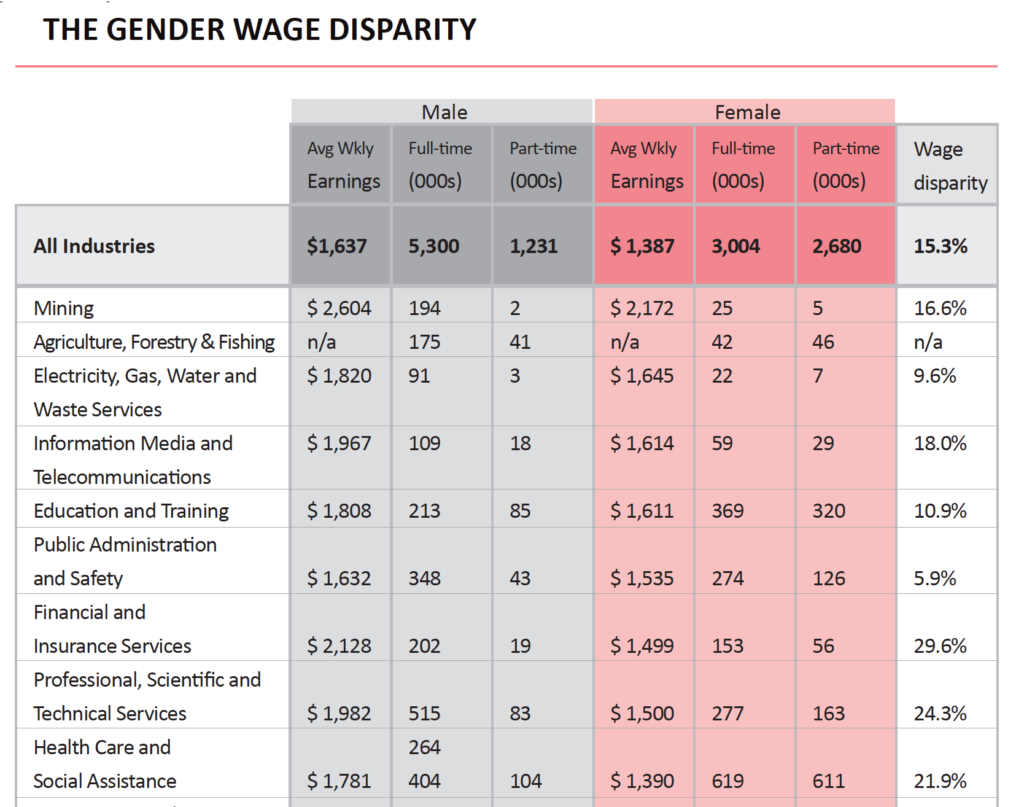

As we found in the June quarter Financy Women’s Index, the average weekly salary of a woman in health is around $1300, while women working in education and training can expect to earn around $1600 each week.

It’s estimated that some 732 corporations had a combined total revenue of $505.99 billion in 2015-16 and include:

-

Adani paid $0 tax on $723,997,514 revenue

-

Chevron paid $0 tax on $2,142,255,410 revenue

-

Exxonmobil Australia paid $0 tax on $6,728,562,395 revenue

-

Origin Energy paid $0 tax on $12,028,321,361 revenue

“instead of fixing it [the problem], the government is spending $8 million of public funds on an advertising campaign trying to convince voters that the problem is fixed,” says Merope-Synge.

“Far from being fixed, the data released makes it quite clear that the problem is getting worse.

“It’s time for the Turnbull Government to crackdown on tax cheating and close the loopholes that let corporations get away with paying $0 tax.”

A full list of the businesses that failed to pay tax in 2015-16 can be found here.