Prior to this COVID-19 pandemic, Australian women had been on the front foot with closing the gender gap in superannuation, but there are now signs globally that our gains are slipping.

The gap between the average pension pots of men and women in the United Kingdom, aged over 55 widened by $376,000 this year according to a survey of 1000 people published this week by more2life, an equity release provider.

Around one-third of women who took part in this survey, said their financial situation had worsened since the start of the pandemic in early 2020, hampering their ability to fund or save for later life.

Prior to COVID-19 the biggest factors contributing to the gender gap in superannuation savings have been the gender pay gap and time spent out of the workforce caring for children.

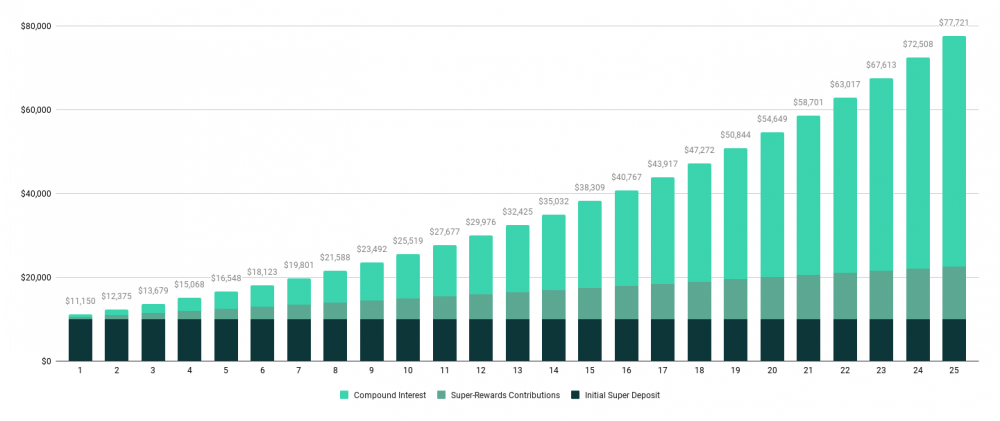

In order to live comfortably in retirement, it’s estimated that couples aged around 65 years need to spend $62,828 per year and singles $44,412, both up by 0.4 per cent on the previous quarter, according to the Association of Superannuation Funds of Australia (ASFA).

But in Australia, the average woman retires with $45,000 or 31% less in their superannuation than the $65,000 for the average man, that’s according to Australian Bureau of Statistics data reported in the Financy Women’s Index.

Now job losses resulting from the pandemic and the need to stay at home to care for loved ones because of forced government lockdowns, are adding to many of the financial disadvantages faced by women and could potentially widen that gender gap in superannuation.

What’s more, take up of the Federal Government’s early access to superannuation scheme, could also have an impact on the gender gap in retirement savings given the already disproportionately lower balances of women relative to men.

So what can you do?

- Check your superannuation savings and consider if you are on track for a “comfortable retirement”

- Ask yourself, what does your retirement horizon look like and are your savings likely to be enough?

If your savings are unlikely to be enough, Pascale Helyar-Moray the CEO, Super-Rewards and Director, Australian Gender Equality Council provides the following strategies to rebuild and boost your superannuation before retirement.

Spouse contribution

If you are not working, or are working part-time, your spouse can receive up to a $540 tax rebate if they contribute an amount up to $3000 to your super.

Your spouse can claim the maximum tax offset of $540 if both of the following apply:

1. Your spouse, whether married or defacto, contributes to your eligible super fund

2. Your income is $37,000 or less.

The tax offset amount reduces when your income is greater than $37,000 and completely phases out when your income reaches $40,000.

Government co-contribution

If your income is less than $41,112, you can contribute up to $1,000 to your super (post tax) in this tax year (2021-22), the government adds up to a further $500.

The Low Income Super Tax Offset

The Low Income Super Tax Offset (LISTO) is a government payment of up to $500 into your super fund.

This payment is designed to help low income earners boost their retirement. If you earn $37,000 or less in a financial year, you may be eligible to receive a LISTO payment of the tax paid on your eligible concessional super contributions, up to a cap of $500.

LISTO is paid directly into your super fund – you just need to make sure your super fund has your Tax File Number (TFN).

Join the Financy social communities that support achieving fearless economic equality on LinkedIn and Facebook or follow our official pages on LinkedIn, Facebook, Instagram and Twitter.