“I don’t want to invest into super. My friends lost money investing in superannuation funds during the 2008 financial crisis.”

This was a conversation I was having with a new client this week. I regularly hear the fear from investors of not wanting to invest in superannuation.

This is due to a very common misunderstanding about what superannuation is.

Superannuation is not an asset.

Superannuation is a tax structure that allows you to invest your retirement savings into assets that are taxed at a lower rate compared to owning the assets in your own name.

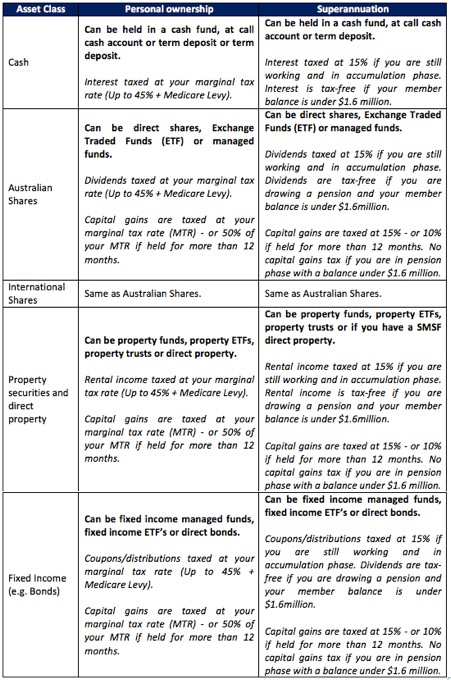

The below table compares owning that same asset in your own name compared to owning exactly the same asset in your superannuation fund:

As you can see from the above, you are able to own pretty much the same assets in your superannuation as you do in your own name.

The difference is how the income and capital gains are taxed. Superannuation is clearly the winner for being a lower taxed environment.

However, you need to consider your age.

If you are going to make additional contributions to your superannuation how long will it be before you have access to that money in a form of a pension from your superannuation fund?

For people in their fifties and sixties, making contributions to superannuation to help save for retirement makes sense.

I generally tell clients that they need to be prepared to invest for a minimum five year time period before they anticipate needing access to that money again.

For a person in their 20s and 30s, locking up their spare savings by making additional contributions may not be the most appropriate decision for their stage of life.

Now that we have clearly understood that superannuation offers pretty much the same choice of assets to invest in as buying them in your own name, there are differences between what superannuation fund you may use.

Your choice spans one of three categories:

- Industry superannuation funds

- Retail superannuation fund

- Self-managed superannuation funds

Each of the above choices will be able to provide your superannuation with an exposure to cash, Australian shares, international shares, property (direct property only for SMSFs) and fixed income securities.

This is where a financial planner can be very helpful in determining what type of superannuation fund is appropriate for you.

But keep in mind, a fee for service financial planner is paid by their clients based on time. Not based on funds under management.

If your financial planner does not include the consideration of industry superannuation funds in their recommendation, and ask them when was the last time they recommended an industry superannuation fund to a client and which one it was, they are not considering all options that may be appropriate for you.