One of the most common goals I hear from people is that they want to give their child a private education.

This desire is generally coupled with the follow up question, can we actually afford to do this? And if so, how?

Any big goal comes with a realisation that there is a big mountain to climb.

However viewing that mountain from the bottom can be overwhelming and generally not helpful to your mental commitment to the plan.

When it comes to education plans, we have seen many times where people have come to see us, having become petrified of the mountain of secondary school fees: 3 children x 6 years each x $25,000 per year per child = $450,000.

Boom – your head just blew up!

But just as you would if you were navigating any long journey, you need to start breaking this down into manageable steps.

1. Stretch your timeline – from now until the youngest finishes – this is a xx year project.

The first step in breaking down this plan is to stretch out the timeframe – start from right now until your youngest child completes their final year of secondary school.

How many years is that? 10, 12, 18 years?

Notice how this has put instantly put long term time horizon on your plan. Dividing the total sum by the number of years starts you thinking about how much you need to contribute to this pot every year and every month.

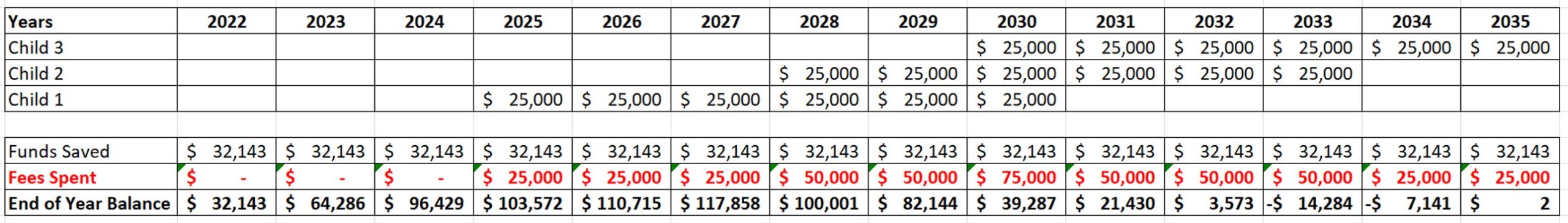

Lets assume it is a 14 year plan and lets use the example above as a basis to show how the big mountain of $450,000 starts to break down. By dividing 14 years into this number, the annual amount needed to be saved is $32,143pa. This equates to $2,679 per month.

It is still a big challenge yet it puts a nice smooth vibe on the plan. But next you need to skew the flow of funds based on the ages of your kids to ensure that there is always sufficient funds in the ‘pot’.

2. Amour up for the ‘overlap’

Climbing the mountain and descending from the top are quite manageable. The hardest part of this education plan are the years where you are funding fees for multiple children.

For some this may mean simultaneously paying 2 or 3 sets of fees in certain years. If you can get through these years, the plan is nearly ‘home and hosed’, so it is important that you plan for the challenge.

Each family has a different age profile and so this can either be front loaded (more fees early in the overall plan) or back loaded (more fees later in the overall plan).

If you are ‘front-loaded’, ie. your older kids are closer in age than the younger, then you have a steep mountain to climb early on in this plan, and may need to knuckle down hard right now, but the fee commitment will fall away sharply as the year progress.

If you are ‘back-loaded’, ie. the younger children are closer in age, you will have larger fee commitments later in the plan, and you need put more away now to build a buffer for those years.

3. How much savings could it take

The example below gives an average amount needed to be saved, it doesn’t account for the bias of years where multiple fees are needed. It is vitally important to plan for those years, to ensure your don’t run out of funds.

Whilst the average saving amount of $2,679 per month ($32,143pa) will pay for all of the fees, they will hit a cashflow wall in 2033 and 2034 and will need to build a buffer for those years by adding some additional savings.

Financy helps women become financially fearless and while we’re at it, we ensure that our members – individuals and organisations – are part of the solution to gender financial equality. Subscribe for FREE to our newsletter or dial things up a notch with a Financy Membership.