Sponsored Post: The latest review into superannuation has attracted a lot of submissions with many pointing to how many Australian women are facing a retirement income gap, exposed to a greater risk of poverty, housing stress and homelessness.

The retirement income gap is real, and women need to consider their investment options early in their working life to stop earning inequality compounding over the course of their career.

Here’s what you need to know:

- Retirement savings inequality

The gap between women and men’s superannuation balance is well documented, with causes flagged in many submissions include women’s lower lifetime earnings and periods of less than full time employment at some point in their adult life (often due to caregiving).

The Workplace Gender Equality Agency (WGEA) noted that while the superannuation gap is narrowing, the inequality is still significant. In 2017-18, the median superannuation balance for retiring women was around 65% of the median balance for men – $119,000 for women (at or approaching 55-64 years) and $183,000 for men.

- Unpaid periods of caring

Chief Executive Women (CEW) highlighted that women are more likely than men to have broken work. “The burden of caring responsibilities continues to fall disproportionately on women, who spend twice as much time in unpaid care as men.”

They are advocating for the superannuation guarantee to be applied to the Commonwealth Paid Parental Leave scheme, noting that some employers have already made this commitment in line with the Fair Work Ombudsman’s best practice guide on parental leave.

The CEW said, “This is a critical step in safeguarding women’s economic security and ensures parents’ superannuation continues to grow while on parental leave, with its impact compounding over the course of their careers to deliver real benefits to women in retirement.”

- Lower voluntary savings (including home ownership)

After the means tested Age Pension and compulsory superannuation, the third pillar of the Australian retirement income system is voluntary savings. If you’re sensing a theme you’re spot on: women’s wealth lags here too, exacerbated by unfavourable property conditions.

National Council of Women said, “Lack of secure housing for older Australians especially older women is almost at crisis point. […] Lack of home ownership for young Australians will mean severe problems for retirement incomes in years to come unless home ownership affordability is addressed.”

How can women plug the retirement income gap?

The Retirement Income Review final report is due in June, but what can women do in the meantime to proactively secure their future through wealth building?

There are fixed-income investment options out there for women to consider so they are comfortable with their risk exposure while also earning meaningful returns.

Peer-to-peer (P2P) lending can offer a middle ground for women who want to earn better returns on their investments, without the volatility of a share market.

P2P lending allows people to invest in a portfolio of consumer loans. P2P lending takes place via an online platform that matches investors’ funds to approved, creditworthy borrowers.

Reasons why investors choose P2P lending:

- Attractive returns: Investing in consumer loans has a solid track record of providing strong returns. Investing with RateSetter could earn up to 7% p.a.

- Regular, stable returns: Investors receive regular income as borrowers make monthly repayments on their loans. As with all investments, your capital is at risk.

- Access for all investors: P2P lending has opened up access to the stable asset class of consumer credit. Investors with Ratesetter, for example, can start investing with just $10.

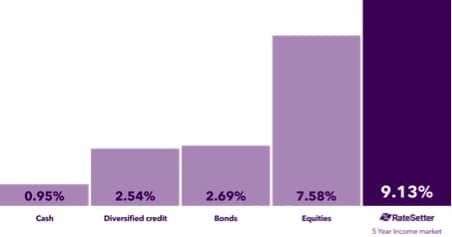

*Annualised asset class returns as reported by Morningstar for the 5-year period to 31 December 2019. RateSetter data not provided by Morningstar.

Ready to start investing? RateSetter are offering Financy readers a $20 bonus if you sign up and invest $100 by 30 April 2020. Terms apply. You can find out more here.

RateSetter 5 year performance represents average matched rate in the 5 Year Income market from 30 October 2014 to 31 December 2019. Other asset class returns based on the average performance of funds in each category as reported by Morningstar for the 5 year period to 31 December 2019. Data gathered from the following Morningstar categories: Australian Cash: AUS, Bond – Australia: AUS, Diversified Credit: AUS, Australian Equities Large Blend Different investments reflect different risk profiles.

All figures stated represent the RateSetter Lending Platform only unless stated otherwise

** Warning: Past performance is not a reliable indicator of future performance. Different investments reflect substantially different risk profiles.

All investments come with some risk and you should investigate any provider’s Product Disclosure Statement. Read the PDS at ratesetter.com.au before investing. RateSetter uses a risk provisioning model where borrowers pay a fee into an independent trust (the ‘Provision Fund’) which is used to cover defaults. To date, no RateSetter investor has lost a cent on any principal or interest owed, however this is not a guarantee or insurance product and your capital is at risk