Investment bonds have benefits and features which are worthwhile evaluating as a way to supplement superannuation or even as an alternative tax-effective vehicle.

Here are two practical case studies that illustrate where investment bonds can actually work for you.

1. When super contribution caps are maxed out – selling a property

Take Anna. She is 55 years old and is on the highest marginal tax rate of 47 per cent and expects to earn $250,000 per annum.

Anna has recently sold down her investment property with net proceeds of $300,000 received.

Her superannuation contribution limits have been capped out but she wants to invest surplus income of $10,000 per annum for the next 10 years.

She is looking to reinvest her property proceeds and surplus income in a tax effective manner.

Strategy

Anna invests her investment property proceeds of $300,000 into an Austock imputation bond and contributes an additional $10,000 each year via a regular savings plan.

Benefit

By age 65, Anna will have contributed $400,000 which she would not have been able to contribute into her superannuation because she has reached her contribution limits.

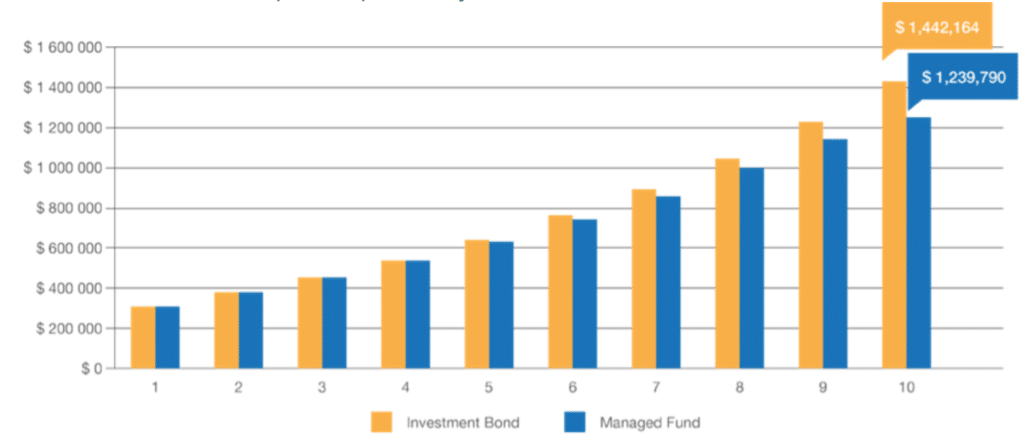

Her investment bond will have reached a value of $709,533 after 10 years.

By contrast, if she had invested her funds into a managed fund, her accumulated value after tax would have been $677,897.

Anna is also able to access her investment bond benefits prior to her intended retirement age if she requires.

End investment balance (after tax) after 10 years.

2. When super contribution caps are maxed out – excess income issues

Susan and John are both in their late forties on very high incomes.

Both are on the highest marginal tax rate of 47 per cent.

They easily use up their annual superannuation caps – after salary sacrificing their maximum contributions – they still have a sizeable surplus.

They currently have $250,000 to invest as a lump sum which they cannot contribute into their superannuation.

They also have annual surplus income of $40,000 which they would like to invest for the long term.

They want a non-superannuation based investment that has ready access and is personally tax-sheltered from on-going investment income.

They also want flexible ownership and control and an investment structure that offers a range of investment options.

Strategy

Both Susan and John each invest separately in an Austock imputation bond with an initial investment amount of $125,000 each.

They each contribute an additional $20,000 each year via a regular savings plan and take advantage of the 125 per cent rule by increasing their regular savings amounts by 10 per cent each year going forward.

Benefit

After 10 years, both Susan and John will have contributed $887,496 which they would not have been able to contribute into superannuation because their contribution limits had been reached.

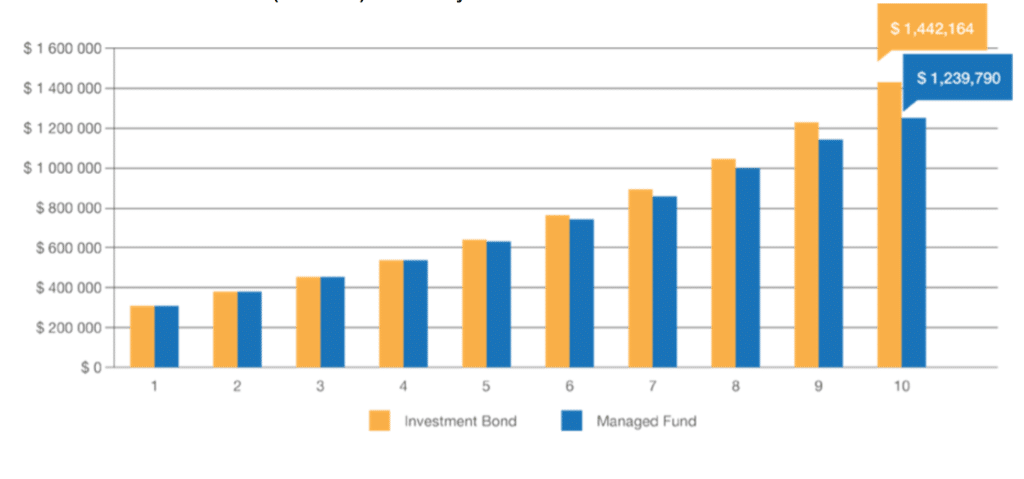

Their investment bonds will have reached a combined value of $1,442,164 after 10 years.

By contrast, if they had invested their funds into a managed fund, their combined accumulated value after tax would have been $1,239,790.

Both Susan and John are also able to access her investment bond benefits prior to their intended retirement age if they require.

End investment balance (after tax) after 10 years.