Investment bonds may sound daunting but really, they’re a lot easier to understand than you may think.

Investment bonds are similar to superannuation.

Let’s talk details:

Throughout a bond’s investment term, the investment bond pays tax annually on behalf of the investor at a maximum tax rate of 30 per cent.

Investment bonds provide unrestricted access to benefits with no preservation age, retirement or purpose test required.

Proceeds received from partial or full withdrawals made after 10 years are considered a tax-free receipt and not subject to personal income tax or capital gains tax.

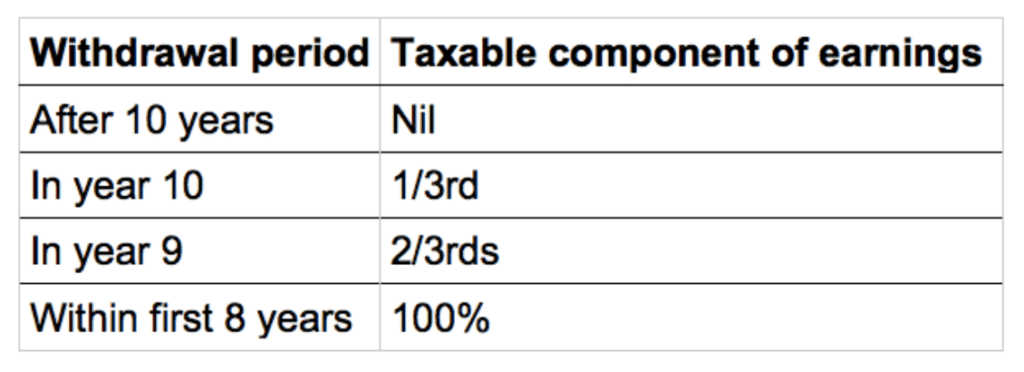

Where an investor fully or partially withdraws from an investment bond within the first 10 years of investment, the earnings component will generally attract personal tax.

The apportioned earnings included in the withdrawal will be assessable as follows.

Investment bonds also have the added flexibility of being able to be transferred to another person or entity with the original investment date carrying over for the purpose of the 10-year period.

Unlike superannuation, there are no work-test or aged based restrictions on investing, so that those over age 65 years can continue to make investment contributions.

Restrictions such as non-concessional contribution caps and concessional contribution caps that limit or penalise excess contributions do not apply.

There are no caps on the amount that can be invested in an investment bond.

You can progressively increase an investment bond’s tax-effectiveness by making ongoing contributions under the taxation law applicable to investment bonds, known as the 125 per cent rule.

Under this rule, the investment bond’s valuable taxation status is maintained when making ongoing additional contributions, provided these do not exceed 125 per cent of the level of contributions made in the immediately preceding 12 month period.

The attraction of the 125 per cent add-on feature is that you can make ever increasing levels of additional contributions.

This can be done at any time during and even beyond the investment bond’s initial 10-year period.

Investment options

You can construct the investment bond’s investment mix by using one or multiple investment portfolios from a range of passively and actively managed funds covering all asset classes including cash, shares, fixed interest, and property.

This provides the flexibility and tax-freedom to change the investment portfolio mix at any time to suit changing circumstances or market conditions, without personal tax or capital gains tax consequences.

Estate planning

Unlike with superannuation, beneficiaries nominated under an investment bond are not required to be a dependant.

As such, there is no restriction on who can be nominated as a beneficiary, which may include a person, company, charity or trust.

There is also no requirement to nominate or re-nominate a beneficiary every three years in order to make the nomination binding (unlike many superannuation funds).