In money news that affects your hip pocket.

This week the big four banks were grilled over what they could be doing better and what they might not be telling customers, yet at the same time a new report emerged accusing mortgage customers of telling furphies.

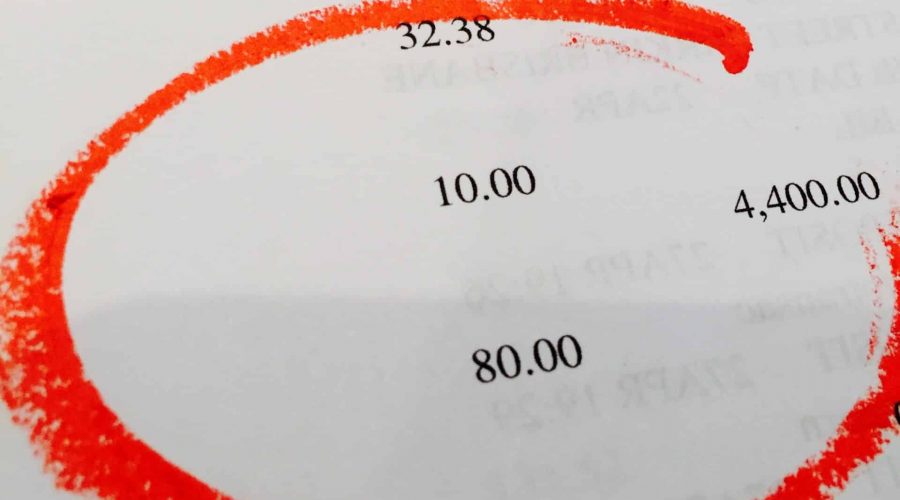

The UBS survey of 1228 Australians who have taken out a home loan in the past two years found only 72 per cent provided information that was “completely factual and accurate”, Fairfax Media reported.

The report also noted that of the customers who stretched the truth to get a home loan, they either overstated their income, under-represented their living costs, or scaled down their debts.

Financy more now on the UBS/Fairfax report?

The head of each of the four big banks faced a Parliamentary Committee hearing this week with plenty on the table from their high credit card fees, pay, complaints and more. Given their poor track record with handling complaints, one of the ideas raised was establishing a banking tribunal funded by the industry.

Westpac chief Brian Hartzer supported the idea to ensure people stop falling through the cracks despite two other complaint handling systems in place, although he stressed he would not want it to add an extra layer of administrative burden – that’s likely to cost us all.

Financy more now on the banking tribunal?

Australians are looking pretty good at saving money despite record low interest rates eating into returns.

According to a new study that relies on OECD data, Australia ranked the 4th highest annual savings of $6,062.56 despite our low cash rate of 1.5 per cent.

Switzerland came in first spot with annual savings of $14,552.91 and it has a negative 0.75 per cent cash rate. Sweden and Norway were the second and third best savers respectively.