The biggest problem with superannuation is that the system is not family friendly and once women fall behind men in lost savings, it’s almost impossible to catch back up.

It’s a problem, a big one. But really, once we get our heads around this then we can start to tackle the problem.

We need to push government to make superannuation a mandatory employer payment while on parental leave, plus scrap that $450 monthly earnings limit that dictates when super will be paid.

Calls for both these simple fixes are gaining momentum, and last week Industry Super joined the chorus.

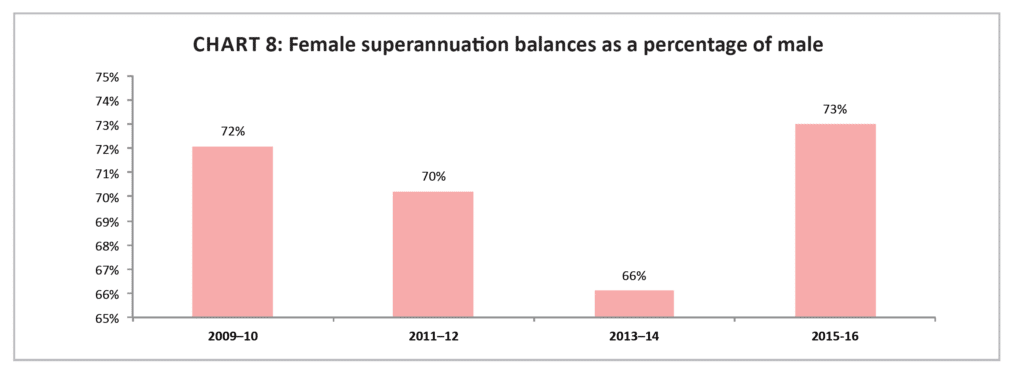

The Financy Women’s Index for the December quarter found that women have about 73 per cent of the lifetime superannuation savings as men.

The gap becomes larger once a woman starts to have children.

Hardly rocket science that time spent out of the work force not earning superannuation is a big part of the imbalance problem.

Analysis of Australian Bureau of Statistics (ABS) data by Industry Super found that the super gap emerges at 14.6 per cent at age 25-34 and peaks at ages 55-64 with men saving 47.4 per cent more.

This means that even if Australia closed the gender pay gap, once a woman falls behind because of time spent out of the workforce caring for loved ones, that it’s going to be very hard to close the gender savings gap in super.

Furthermore, in 2015, more than two-thirds of Australia’s 2.7 million unpaid primary carers were women. The calculated replacement value of this unpaid care was over $60 billion.

This $60 billion figure is truly staggering, which makes me think that women should be earning double the amount of interest in superannuation while on parental leave. Or any primary carer for that matter!

What can be done to close the gap?

Industry Super has proposed that the Australian government allow super on parental leave, as well as scrapping the monthly $450 Super Guarantee threshold that most affects women.

Industry Super Head of Consumer Advocacy, Sarah Saunders, says the findings “underscore the toll of interrupted work patterns and lost compound returns on women’s retirement savings”.

“While a woman might return to a good salary after time out to care for a child or an ageing parent, she will have little chance of ever making up the super shortfall.

“That women today face thirty years in retirement with half as much super as men – because the system doesn’t put an economic value on unpaid care – is unacceptable.

“Business and government policy must better reflect how women transition in and out of paid employment.

Examples include flexible working hours, more accessible childcare, and super on parental leave and casual or part time work.

“The super shortfall highlights the importance of ensuring that the Age Pension safety net keeps pace with living standards by continuing to link it to wages rather than CPI,” she said.