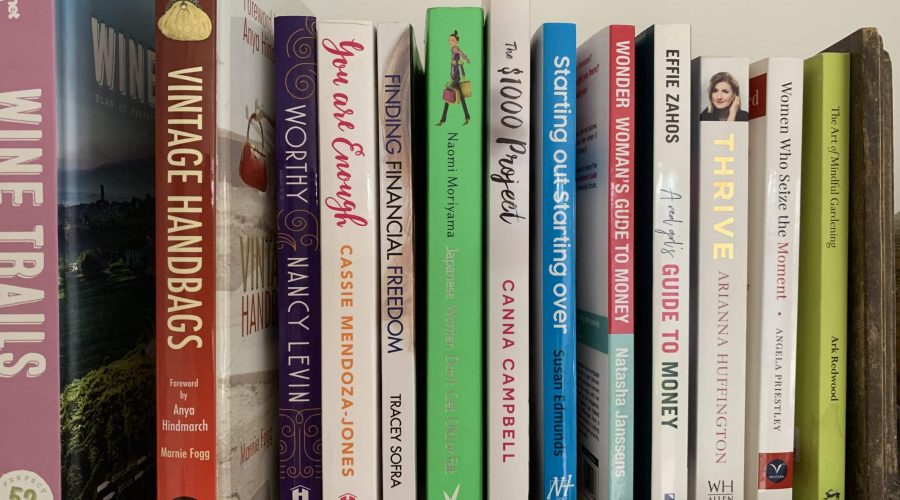

Australian women have a lot of choice at the moment if they want to read a book to help them with money.

In my experience as a women’s money columnist, never before has there been so many “guide” books on the market to help women invest and become better money managers.

The only problem I see, is how do you choose between them?

The appetite for women’s personal finance books is likely to have been fuelled by two things, a global push to support women’s economic empowerment and the rise of women’s wealth, largely due to greater workforce participation.

The gap between the net wealth of Australian women and men has also shrunk to 12.3% from 27.4% in 2007, according to the latest Roy Morgan Wealth Report.

Lately four books have come across my desk, all of which promise to be the “guide” for women on money but each offer a different take for women, such as strategies to invest in the share market, property, to understanding all the ins and outs of finance and money management for just about every life stage.

Here’s what you can expect from each of them.

The $1000 Project

Written by Canna Campbell, a financial planner who’s money tips and minimalist approach to living has allowed to build up a massive 100,000 fan base on social media.

This book is honest, grounded and smart. It is not necessarily gendered, and some men will enjoy reading it too, but Canna’s personal take on life, plus the up and down of her experiences, will make it particularly relatable to women.

For me, it’s a great bedside table read to enjoy with a cup of pepperment tea, feet up and to feel inspired to create wealth. It is perfect for women who want to invest in the share market now by taking little steps towards passive income – that’s income you make while you are sleeping.

Canna’s next book, Mindful Money will be released in August, and it goes a bit further in technical information and investment strategies but it uses illustrations to drum home the point and engage the reader.

A Real Girl’s Guide to Money

Written by Effie Zahos, former editor of Money Magazine and regular money commentator on Channel Nine.

This book is clever, real and beautifully published. It actually surprised me because it was so packed with thought provoking facts, information and practical tips to get you thinking about money and taking control of your situation, that I realized I could be doing better, a lot better.

My favourite chapter was “Kids cost a bomb” and what Effie does here in relation to raising a family particularly around private versus public schooling is state the obvious in a non-judgmental way – that is, if you can’t afford it, don’t do it.

It’s possible to read this book by whichever chapter is most relevant to you, and because of this, it is a perfect coffee table book to keep you in check.

Effie’s 26-week challenge is a call to action and will provide a sense of economic empowerment.

Wonder Woman’s Guide To Money

Written by financial planner and accountant Natasha Janssens. This book is like carrying a financial planner around in your hip pocket. It’s often methodical in number crunching, yet easy to read and timely.

This one covers a lot in detail and blends case studies with famous investor quotes to help energise the reader into taking a staged approach. It’s likely to really appeal to women who are, or want to invest in the property market, and it gives some timely insights on low interest rates and how to navigate the banks.

Highly motivational for me was the “Lighten the Load” chapter, which looks at how women tend to prioritize all their other to-do lists, before their finances.

In this book, Natasha doesn’t say forget about that list, but she helps you work out what’s important to create healthier money habits.

Starting Out Starting Over – a single woman’s guide to money in Australia

Written by Susan Edmunds, a New Zealand business journalist. This book is simple, thought provoking and interactive – like having your very first money diary.

It is aimed at single women who might be starting out or as she says, starting over due to divorce or other life events.

It’s not a deep dive into finance or investing rather what it does do is present quite a lot of information in a non-intimidating framework, so you won’t have to re-read to check that you got the point.

For this reason it’s a good appetiser to get you thinking and it will give you enough options to help you take the first step.

This Financy article was first provided to and published by Yahoo Finance and has been republished here with permission.