As the pool of female wealth rises, women are becoming more active share market investors, particularly when it comes to trading global shares.

Digital platform Stake claims it has seen a 530 per cent increase in the number of women investing through its global trading services over the past six months.

It comes as new research by Merrill Lynch and Age Wave shows that the retirement age wealth gap between men and women has widened to reflect over $1-million.

At the same time, other research shows that between 2010 and 2015, the value of women’s wealth in the United States grew from $US34 trillion ($A43 trillion) to $US51 trillion, according to the Boston Consulting Group.

Women’s wealth is also rising in Australia with higher rates of female workplace participation, and more women outliving men and inheriting the most wealth.

One of the trends that’s emerged with the significant increase in female traders on Stake’s platform, is that women are outperforming men on global share market returns.

The company, which allows you to buy and sell shares like its happening in an online shoe store, says between August 2017 and March of this year, the top five shares bought by women averaged a yearly return of 85.01 per cent versus men at 72.23 per cent.

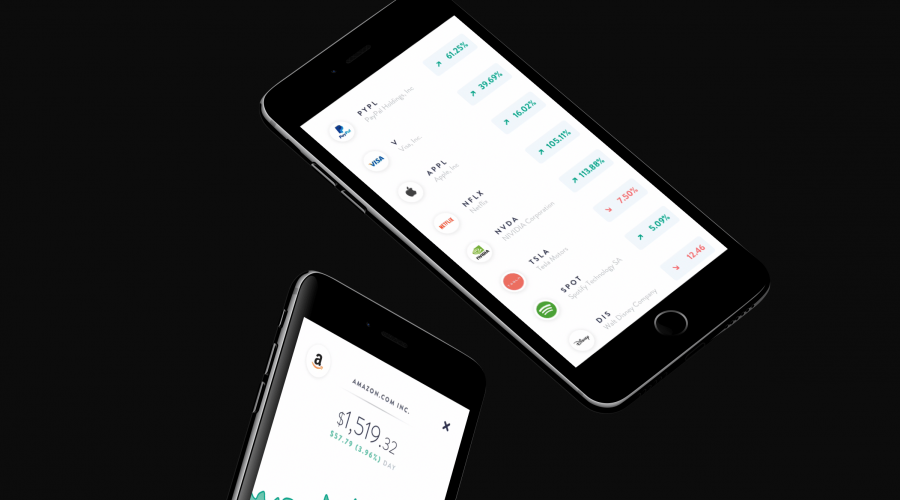

These top five stocks that women invested in were Amazon.com, Tesla, Apple, Square and PayPal Holdings.

The gender performance findings support other research which shows that while women are less likely to enter the stock market, once they do, they smash it.

According to a UNSW Business School report, The gender face-off: Do female traders come out on top in terms of trading performance? female individual investors outperform domestic and international institutional investors.

Despite this kind of research, men remain the most active share market traders. A common view about why this might be is that some women believe investing in the stock market is likely to be complicated and confusing.

In addition to that, if you go onto most trading websites and you’ll see more pictures of men in suits and lots of industry jargon—these platforms don’t seem as relevant to a new to trading female audience.

In light of the interest in Stake’s platform from female traders, the company is looking to launch an event series called Martinis & Markets later this year, to further help women talk about investing and trading.

The aim is to make trading more accessible, so everyone feels they can be in the market.

Stake makes money when you transfer money from Australian dollars to US dollars. But does not charge a brokerage fee.

They charge 0.7 per cent on the foreign exchange rate at the time you transfer, rather than on every single trade, like some bank brokers. You can keep your money in US dollars for as long as you want.

Here are Stake’s three tips for the first-time female trader:

- Find a platform that you can easily use. Making decisions on what and when to trade should take up your energy, not actually using the platform.

- Get access to companies you think are most likely to grow. Don’t just settle for those listing in Australia. The US market is where most growth companies are listed and you can access them more affordably than trading at home.

- Do your research but don’t let it paralyse you. You will make mistakes, but you’ve got to start somewhere. Remember: on average, cash in the market makes more money than cash in the bank – use that to keep you going.

To date, more than USD$35 million has been transacted on the platform and they’re launching an app in July 2018.