The latest Financy Women’s Index shows the economic progression of Australian women suffered a disappointing setback in the first half of 2018 and is yet to fully recover from a drop in workforce participation and female board representation.

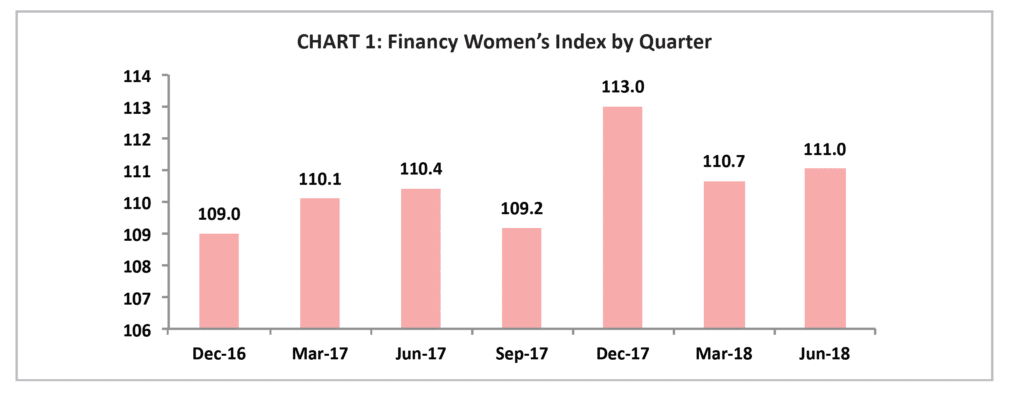

The lndex recovered by 0.3 percentage points to 111 points in the three months to June, from 110.7 points in March however the June result remains 2 percentage points lower than the revised 113 point score achieved in the December quarter – when the Index hit a record high.

“While it’s pleasing to see that the Financy Women’s Index recovered a bit in the June quarter and remains in a rising trend, its disappointing that it remains down from its December high, not helped by a setback in women in board positions,” said Dr Shane Oliver Chief Economist AMP Capital.

Key findings:

- The Index edged 0.3 percentage points higher to 111 points in the June quarter from March

- The June quarter result continues to lag the December quarter and is down 2 percentage points from 113 points

- The June rebound was helped by board appointments and jobs growth

- Women are still faced with a national gender pay gap of 15.3 per cent and a superannuation savings gap of 30 per cent at retirement age.

December remains a standout period for economic progress among women thanks to a jump in jobs for women, particularly retail and mining, as well as there being more women represented as a percentage on the boards of the top 20 listed companies by market capitalization.

Despite the first half fall in economic progress, the Women’s Index is up 1.4 percentage points this financial year.

The female participation rate is 60.5 per cent, the same as what it was in the December quarter, but up slightly on the 60.4 per cent in the March quarter.

The country’s highest paying sector mining, shed 6,000 female employees, yet added 17,000 male employees in the six months to June, compared to the December quarter.

“Improving the positioning of women in our economy is critical from a social and ethical point of view but its also critical in terms of supporting growth in our economy,” said Dr Shane Oliver.

“Greater female participation in our economy can help soften the impact of the aging population. And perhaps even more importantly a more gender diverse economy will be a more productive economy,” he said.

The number of women represented on top ASX 20 boards increased slightly in the six months to June 2018, but still trails the December quarter.

The Index found that female board members held 30.2 per cent of positions in the top 20 companies in the period to June, a small gain on the 30.1 per cent in the three months to March of this year.

The June result is 1.9 percentage points less than in the December quarter, according to revisions in the Index and the use of calculations contained in the Gender Diversity Progress Report by the Australian Institute of Company Directors (AICD).

“Until we can have objective discussions and debates around the real corporate issues without turning all debates into gender specific matters, we never will make meaningful progress,” said OneVue Managing Director Connie McKeage.

Philip Kewin, chief Executive of the Association of Financial Advisers (AFA) said the latest Financy Women’s Index results indicate that progress towards creating positive and meaningful cultural change in the financial wellbeing of women in Australia is happening slowly.

“It is disappointing to see that, at 26.1 per cent, the financial and insurance services industry has the highest pay disparity of all industries.”

To help better understand women and their economic progress, an Advisory Committee was appointed in June 2018 to review and help grow the Index, which will also undergo further developmental changes and enhancements to ensure the integrity of future reports.

This Committee includes AMP Capital’s Head of Investment Strategy and Chief Economist Shane Oliver, Australia and New Zealand Banking Group’s Senior Economist Joanne Masters, Deloitte Access Economics Partner Nicki Hutley, Melbourne Institute of Applied Economic and Social Research Professorial Research Fellow Roger Wilkins and Agenda Agency founder Heidi Sundin.

“I’m excited to be involved with the Financy Women’s Index,” said Jo Masters Senior Economist Australia and New Zealand Banking Group. “Measuring the economic progress of women in Australia will hopefully highlight the economic issues that women face and shape the policy debate about how these may be addressed.

“Women’s economic empowerment is critical to achieving gender equality,” said Agenda Agency Founder Heidi Sundin.

“This Index provides a way of tracking women’s economic progress in Australia and understanding where further interventions are required to drive change.”

The Index also shows that women continue to enrol in tertiary studies at a faster rate than men, and trends suggests that the pace of growth is highest in courses that align with higher paying careers such as information technology (IT) and engineering.

“It’s encouraging to see more women enrolling in tertiary studies than men, and strong growth in female enrolments in courses that align with higher paying careers. However, there continues to be challenges around retaining women in the workforce, with female participation rates continuing to dip in the 30-39 year old bracket,” said Ms Masters.

Data provided to the Women’s Index by the country’s biggest super fund AustralianSuper, shows that while the gender gap in super is improving, it’s not happening fast enough.

“Further work is still needed in the areas of equal pay, equality of opportunity and more equal sharing of family responsibilities to close the gap which results in too many women having insufficient savings to fund a comfortable retirement,” said Rose Kerlin Group Executive Membership AustralianSuper.