There’s something not right with the latest inflation expectations figures and gender has everything to do with it.

The latest inflation expectations by gender and age published by Roy Morgan shows that the gap between what women and men think will happen to the cost of goods and services is persisting and has widened slightly in recent months.

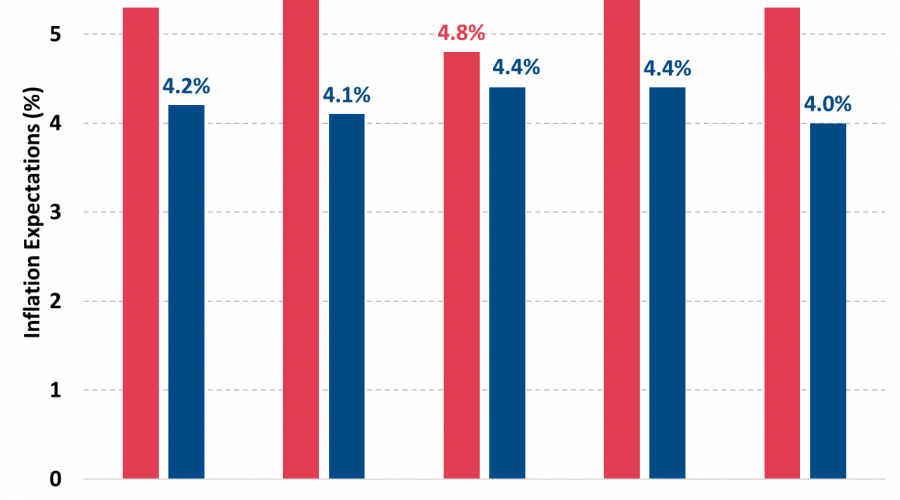

Women’s Inflation Expectations are at 5.3% in October 2021 compared to 4.2% for men. By comparison, overall inflation Expectations are now 0.1% points above the long-term average of 4.7%, for the first time since June 2012.

Inflation Expectations are highest for people aged 50-64 at 5.0%. Of this group, women have Inflation Expectations of 5.6% compared to only 4.4% for men – a difference of 1.2% points.

There is also a large gender gap of 1.3% points for people at either end of the age spectrum. For people aged under 35 women have Inflation Expectations of 5.4% compared to 4.1% for men and those aged 65+ women’s Inflation Expectations are 5.3% compared to 4.0% for men.

The only exception to this trend is for people aged 35-49 who have Inflation Expectations of 4.6% – the lowest of any age group. In this group the gender gap is only 0.4% with women’s Inflation Expectations of 4.8% slightly higher than that for men of 4.4%.

What’s interesting about these figures is that they represent a greater level of concern among women, relative to men, in terms of what’s likely to happen to the cost of living over the next two years.

Here’s what’s happened in the September quarter:

- Food prices rose by 0.3%

- Prices for “eating out” rose because in the prior quarter they fell as consumers in NSW and Victoria used government voucher schemes.

- Fruit prices were lower from better supply of some items but also reduced demand from the food services industry as NSW and Victoria were in lockdown.

- Alcohol & tobacco fell by 0.5% as the 12.5% increase in the tobacco excise wasn’t in place anymore.

- Clothing & footwear prices fell by 3.8% from lower demand and winter discounting.

- Housing was 1.7% higher from higher costs for new dwelling construction (related to increased costs for both materials and labour).

- Property rates also increased substantially (the highest rise since 2016), following freezes in 2020 from the pandemic.

- Furnishings, household equipment and services prices were 1.6% higher, with furniture prices up strongly (+3.8%) because of higher demand and also supply shortages.

- Childcare costs also rose but this is related to the unwinding of free childcare in 2020.

- Health prices were flat with medical and hospital prices up from the Medicare benefit schedule indexation while pharmaceutical prices fell as more consumers qualified for the Pharmaceutical Benefits Scheme.

- Transport prices rose by 3.2%, with the largest driver the 7.1% increase in fuel prices which added 0.3 percentage points to inflation (with Brent oil prices now tracking at the highest level since 2014 from higher demand as the global economy opens up but also because supply hasn’t been ramped up enough). Motor vehicle prices rose by 1.4% as motor vehicle parts are facing supply constraints.

- Communication prices fell by 0.5%

- Recreation and culture was up by 0.9% driven by higher prices for audio, visual and computing goods (related to higher demand and also the supply constraints).

- Education prices rose by 0.1%

- Insurance and financial prices were 0.6% higher

As a generalisation, women tend to be more risk averse than men when it comes to spending, and to that extent the higher inflation expectations may not be entirely unexpected.

But what is also important to note is that when it comes to household purchases, women make the majority of these decisions and so are more likely to have their fingers on the pulse when it comes to price expectations.

Given that women’s inflation expectations are more in line with what the market is now expecting, this could be seen as more of a guide for what’s to come in price pressure continues.

That said, Dr Shane Oliver, chief economist at AMP expects that price pressures will come off the boil towards the end of next year.

“There has been a big rise in consumer demand for goods (consumers are cashed up from government fiscal transfers and can now unleash this spending as economies open up), higher energy prices (for gas, oil and coal) filtering into producer and consumer costs and manufacturing bottlenecks in production and shipping (as companies are struggling to meet the high level of consumer demand while also dealing with closures of factories due to coronavirus outbreaks).

“Most of these factors are likely to be temporary because they are related to disruptions from COVID-19.

“Consumer spending should start rotating from goods to services as economies open up which will relieve pressure from goods inflation.”

Let’s hope Dr Oliver is right!